Top 10 Hedge Fund companies & Hedge Fund Managers in the world

Hedge funds are speculative investments that use various techniques, such as leveraged derivatives, short-selling, and other theoretical strategies, to outperform the market. Hedge funds make both domestic and international investments. With minimums of $1 million, high-net-worth individuals, pension funds, and institutional investors are typically targeted.

As a result, hedge funds are invariably riskier than traditional investments. They are not subject to the same regulations as mutual funds, and they are not required in the United States to file reports with the Securities and Exchange Commission (SEC). Hedge funds have recently gained attention due to the GameStop/WSB debacle, which sparked an US-versus-them mentality among smaller investors.

Taking a Step into the World of Billions

Even though the wealth management industry fees have been under pressure for years, the earnings of the best in the business have largely remained unchanged. The two-and-twenty model has long been the standard fee structure for hedge funds, with 2% of all assets under management (AUM) and 20% of profits based on performance. When you consider that hedge fund AUM exceeds $100 billion, this seems like a lot of money.

Hedge fund managers aren’t your typical stock pickers. They frequently engage in sophisticated investment strategies such as shorting, leaving most market participants perplexed. To be successful, hedge fund managers must have a competitive advantage, a well-defined investment strategy, a large amount of capital, a strong marketing plan, and a robust risk management strategy. A hedge fund is a type of investment vehicle and a business structure that pools funds from multiple investors and invests them in securities and other financial instruments.

Professional management companies organized as limited partnerships or limited liability companies typically manage hedge funds. They are distinct from mutual funds in that there are no leverage restrictions, and the majority of the investments are highly liquid. Hedge fund managers are regarded as the market’s big fish. They not only manage billions of dollars in assets, but they also generate billions of dollars in revenue. Here’s a quick rundown:

1-Blackrock Advisors

BlackRock (BLK) is an investment company based in New York managing trillions of dollars in assets. The company’s largest subsidiary, BlackRock Fund Advisors, has been in operation since 1984 and has an asset of $1.9 trillion. Founded in 1994, BlackRock Financial Management now manages assets worth $2.25 trillion. BlackRock Advisors, the internal hedge fund of the company, was founded in 1994 and manages $789.57 billion in assets at present.

2-Bridgewater Associates

Based in Westport, Connecticut, Bridgewater Associates is a financial consulting firm that works with pension funds, foreign governments, central banks, university endowments, charitable foundations, and other institutional investors.

The company provides four primary funds:

- Pure Alpha is an active investing mutual fund.

- Pure Alpha Major Markets is a subset of the investment opportunities available through the Pure Alpha fund.

- All-Weather is a business that uses an asset allocation strategy.

- A good example is an Optimal Portfolio, which combines aspects of the All-Weather fund with active management.

3- Renaissance Technologies

Renaissance Technologies is a quantitative hedge fund based in New York that uses mathematical and statistical methods to uncover technical indicators that drive its automated trading strategies. Renaissance uses these strategies to trade equities, debt instruments, futures contracts, forward contracts, and foreign exchange in the United States and worldwide.

4- AQR Capital Management

AQR Capital Management, based in Greenwich, Connecticut, creates financial models for value and momentum investing based on quantitative analysis. ACR’s strategies are implemented through mutual funds, sponsored funds, and managed accounts, as well as Undertakings for Collective Investment in Transferable Securities, a type of mutual fund offered in Europe.

AQR had $164 billion in managed assets as of 31 March 2020. It also received $224.8 billion in advice on assets. With partners John Liew, Robert Krail, and David Kabiller, Cliff Asness has founded the company. The four had collaborated in a Goldman Sachs hedge fund.

5- Man Group

This UK-based hedge fund has over 230 years of trading experience. In 1784, it began as the Royal Navy’s sole supplier of rum and later expanded into sugar, coffee, and cocoa trading. As of December 31, 2020, Man Group managed $123.6 billion in assets.

6- Two Sigma Investments

John Overdeck and David Siegel founded Two Sigma Investments in New York in April 2002. The company employs quantitative analysis to create mathematical strategies based on historical price patterns and other data. As of March 31, 2021, Two Sigma Investments had $68.9 billion in assets under management.

7- Citadel Advisors

Citadel Advisors, based in Chicago, specializes in equity, fixed income, macro, commodities, credit, and quantitative strategies. Citadel managed $33.1 billion in assets as of March 31, 2021. Kenneth Griffin, the company’s founder, began trading from his dorm room in 1987 as a 19-year-old sophomore at Harvard University. He established a citadel in 1990.

8- Davidson Kempner Capital Management

The New York-based firm Affiliate offices of Davidson Kempner Capital Management can be found in London, Hong Kong, and Dublin. The firm began managing capital for investors in 1987. Among the topics covered are bankruptcies, convertible arbitrage, merger arbitrage, distressed investments, event-driven equities, and restructuring situations. As of January 31, 2021, Davidson Kempner had $34.8 billion in assets under management and $33.1 billion in net assets under management.

9- Millennium Management

Millennium Management was established in 1989 and is headquartered in New York. The firm’s discretionary advisory services are available to private funds. As of December 31, 2019, Millennium had $42 billion in assets under management. Following a career on the American Stock Exchange as a floor broker, trader, and options specialist, Israel Englander founded Millennium with $35 million in the capital.

10- Elliott Management

The investment mandate of Elliot Management is described as “extremely broad,” encompassing almost every asset type, including distressed securities, equities, hedging and arbitrage positions, commodities, real estate-related securities, and so on.

In August of this year, Elliot purchased Barnes & Noble. It had previously purchased Waterstones, a British bookshop. The company was founded in 1977 by Paul Singer and is based in New York. As of December 31, 2019, Elliot had $73.5 billion in assets under management and $40 billion in discretionary assets.

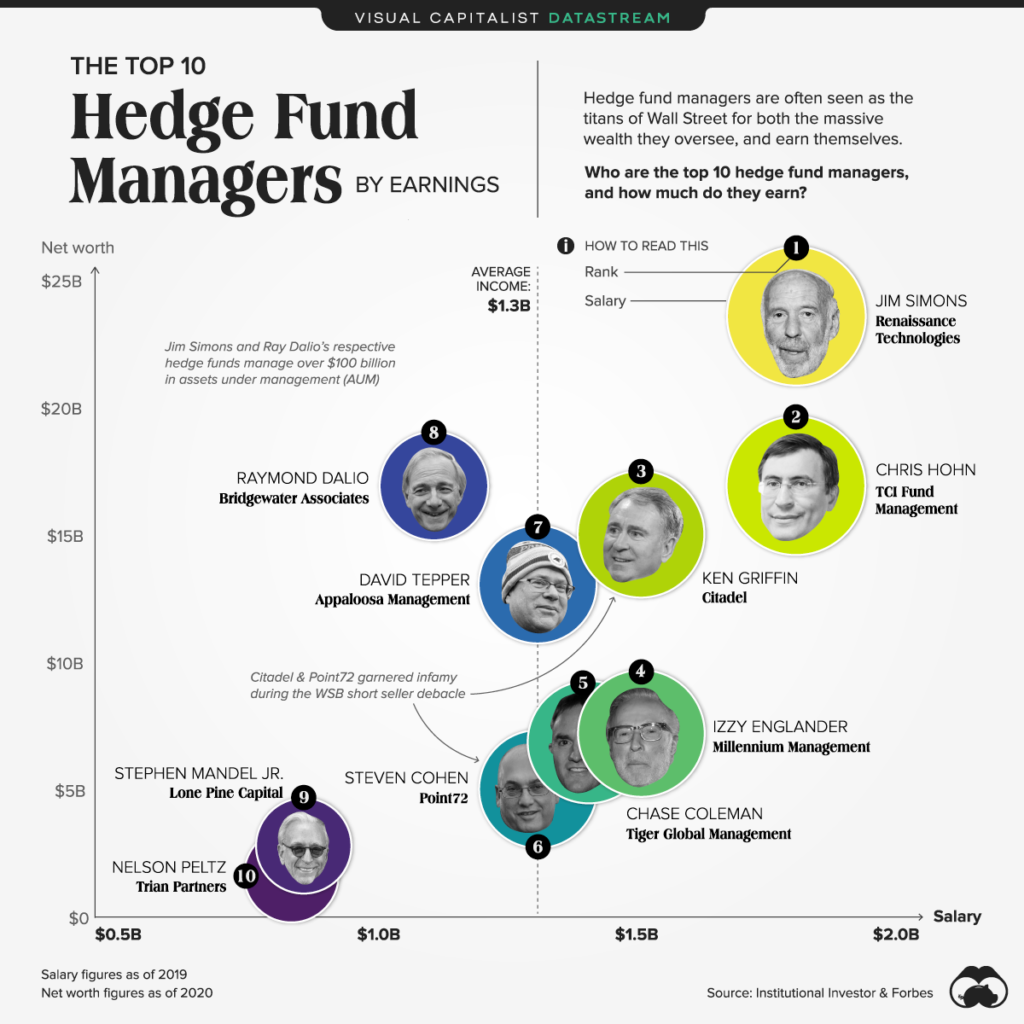

The World’s Top 10 Hedge Fund Managers

In fact, the top 10 hedge fund managers combine for $108 billion in net worth:

| Manager | Salary Earnings ($M) | Net Worth ($M) | Fund |

|---|---|---|---|

| Jim Simons | $1,800 | $23,500 | Renaissance Technologies |

| Chris Hohn | $1,800 | $16,900 | TCI Fund Management |

| Ken Griffin | $1,500 | $15,000 | Citadel |

| Izzy Englander | $1,500 | $7,200 | Millennium Management |

| Chase Coleman | $1,400 | $6,900 | Tiger Global Management |

| Steven Cohen | $1,300 | $5,000 | Point72 |

| David Tepper | $1,300 | $13,000 | Appaloosa Management |

| Raymond Dalio | $1,100 | $16,900 | Bridgewater Associates |

| Stephen Mandel Jr. | $835 | $2,800 | Lone Pine Capital |

| Nelson Peltz | $835 | $1,700 | Trian Partners |

1. Jim Simons –

James Harris Simons, or Jim Simons, is known as the “Quant King” and one of the greatest investors of all time, after having started one of the most successful quant funds in the world, Renaissance Technologies (“Rentech”). Simons founded Rentech in 1982 at just 44 years old. He served as the chair and CEO until 2010 when he retired from his role. He still remains as a non-executive chair.

KEY TAKEAWAYS

- Jim Simons is known as one of the greatest investors of all time, due to the long-term returns of his quant fund Renaissance Technologies and its flagship Medallion Fund.

- Simons served as CEO and chair of Renaissance Technologies from its founding in 1982 until 2010 when he stepped down. Prior to a career in finance, Simons was also a successful mathematician and taught at MIT, Harvard, as well as served as the chair of the mathematics department at Stony Brook University.

- As of 2021, Forbes estimated Jim Simons‘ net worth at $23.5 billion, making him the 23rd richest person in the United States.

2. Chris Hohn

CHRIS HOHN

Founder, Chair of Board, Founder Member

CHRIS IS THE MANAGING PARTNER AND PORTFOLIO MANAGER OF THE LONDON-BASED HEDGE FUND, THE CHILDREN’S INVESTMENT FUND (TCI).

Before setting up TCI, he managed investment strategies for other hedge funds for almost a decade.

Chris received an MBA from Harvard Business School and a BSc in accounting and economics from Southampton University. He was knighted in 2014 for services to philanthropy.

3. Ken Griffin

Founder & CEO, Citadel LLC

- Ken Griffin founded and runs Citadel, a Chicago-based hedge fund firm that manages roughly $34 billion in assets.

- He founded Citadel in 1990 but first began trading from his Harvard dorm in 1987. He put a satellite dish on the roof to get real-time stock quotes.

- He is the founder of Citadel Securities, one of Wall Street’s biggest market-making firms, responsible for one of five stock trades in the U.S.

- He has donated more than $1 billion in his lifetime, including more than $300 million to nonprofits in Chicago.

- Griffin has spent $800 million in recent years snapping up high-priced homes in cities like London, New York and Palm Beach.

4. Izzy Englander

Founder, Millennium Management, L.L.C.

- Israel Englander founded Millennium Management in 1989 with $35 million. Now, the hedge fund firm manages nearly $50 billion.

- Israel Englander, or Izzy, is the son of Polish immigrants.

- Englander’s hedge fund uses a multi-manager platform, feeding more capital to those who perform well and getting rid of traders who perform poorly.

5. Chase Coleman, III.

Founder, Tiger Global Management

- Chase Coleman started out as a hedge fund investor, but his Tiger Global Management has evolved into a broader investment firm.

- Tiger Global Management oversees some $40 billion in assets. Its venture capital arm is now its biggest unit.

- Prior to starting Tiger Global, Coleman worked for hedge fund legend Julian Robertson.

- His long-term partner, Lee Fixel, quit in 2019. Fixel oversaw Tiger Global’s venture funds.

6. Steve Cohen

Founder, Point72 Asset Management

- Steve Cohen oversees Point72 Asset Management, a $16 billion hedge fund firm that started managing outside capital in 2018.

- For years Cohen ran SAC Capital, one of the most successful hedge funds ever.

- Cohen was forced to shut down SAC Capital after the firm pleaded guilty to insider trading charges that cost Cohen $1.8 billion in penalties.

- Point72 has reopened to outside money in 2018 after expiration of a two-year supervisory bar from the Securities and Exchange Commission.

- Cohen has given $715 million to philanthropic causes over his lifetime, including causes related to veterans and children’s health.

7. David Tepper

President and Founder, Appaloosa Management

- David Tepper, arguably the greatest hedge fund manager of his generation, has been steadily returning money to client investors in recent years.

- Tepper’s Appaloosa Management hedge fund firm now manages nearly $13 billion, down from a peak of $20 billion.

- He decided to move from New Jersey to Florida in 2016 and relocated his hedge fund firm there, but moved back to New Jersey in late 2020.

- In 2018, Tepper bought the Carolina Panthers professional football team in a $2.3 billion deal.

- Once the head of the junk bond desk at Goldman Sachs, he left after being passed over for partner and founded Appaloosa Management in 1993.

8. Ray Dalio

Founder & Co-Chief Investment Officer, Bridgewater Associates

- Ray Dalio is the founder of the world’s biggest hedge fund firm, Bridgewater Associates, which manages roughly $150 billion.

- Working to make sure Bridgewater survives him, Dalio moved in 2018 to turn Bridgewater into a partnership and give employees more of a stake in the firm.

- Dalio grew up in a middle class Long Island neighborhood and started playing the markets at age 12, getting tips from golfers for whom he caddied.

- In 1975, after earning an MBA from Harvard Business School, he launched Bridgewater from his two-bedroom New York City apartment.

- Dalio has given more than $850 million to philanthropic causes. His Dalio Foundation has supported microfinance and inner-city education.

9. Stephen Mandel, Jr.

Founder, Lone Pine Capital

- One of Julian Robertson’s “Tiger Cubs,” Stephen Mandel started his hedge fund firm, Lone Pine Capital, in 1997.

- Mandel stepped back from managing investments for Lone Pine Capital in January 2019 but remains a managing director.

- Mandel built up a reputation as one of the hedge fund industry’s best when it comes to fundamental analysis and bottom-up stock picking.

- Mandel has poured hundreds of millions into his Zoom Foundation. The hedge fund also has its Lone Pine Foundation.

- He is a big donor to charter schools and sits on the national board of directors of Teach for America.

10. Nelson Peltz

Founder, Trian Fund Management

- Nelson Peltz, an activist investor, is a founder of investment firm Trian Fund Management.

- Trian now has $8.5 billion in assets under management.

- The firm has a highly concentrated portfolio that includes stakes in Bank of New York Mellon, DuPont and food conglomerate Mondelez International.

- In early 2017, Peltz battled with Proctor & Gamble over a board seat the company didn’t want to grant him. He ultimately won the seat.