Risk Management and Free Trading Signals: A Powerful Duo for Investors

The world of trading offers a landscape rich with opportunities for financial growth and success. Mastering this realm requires more than just intuition; it demands a strategic approach where knowledge and timing converge. Leveraging the benefits of informed trading can unlock doors to significant gains, turning market volatility into a canvas for profitable decision-making.

Central to this strategy are free trading signals, an invaluable asset for any trader. These signals, when paired with robust risk management techniques, create a powerful toolkit for investors. This article delves into how free trading signals can transform your trading experience, offering insights and guidance for navigating the complex yet rewarding world of financial markets.

Understanding Risk Management in Investing

The importance of risk management in trading cannot be overstated. It involves strategies and techniques to minimize losses and maximize gains. Effective risk management is about understanding and managing the risk-reward ratio in trading, which is essential for long-term success in the financial markets.

The Role of Free Trading Signals

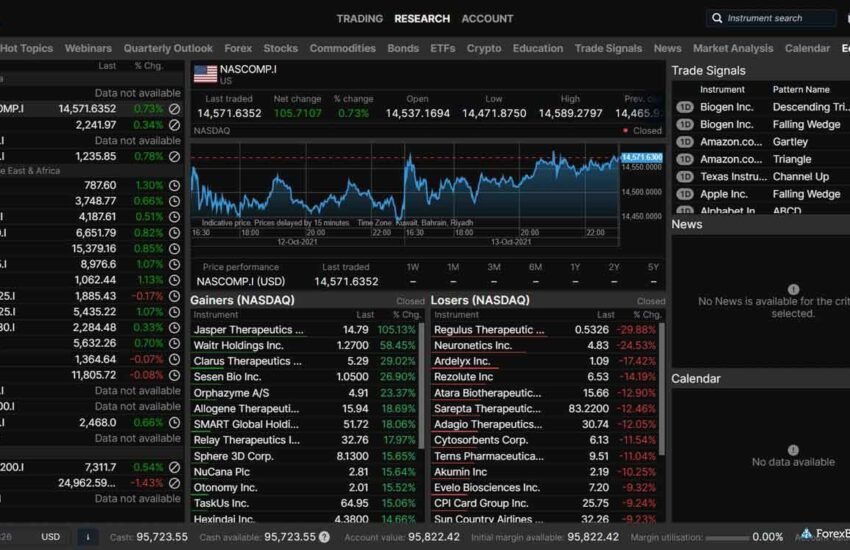

Free trading signals provide investors with real-time market information and insights into potential trade opportunities. They can be valuable in analyzing market trends with signals, offering guidance on entry and exit points in trading. However, it’s important to evaluate the accuracy of these signals and understand their limitations.

Synergy of Risk Management and Trading Signals

The fusion of risk management and free trading signals creates an accessible and powerful approach for traders of all levels. Here’s how these elements work together seamlessly, making trading decisions easier and more effective:

- Guidance from Free Trading Signals

Free trading signals provide timely information on potential entry and exit points, making the complex task of market analysis more straightforward. These signals, often based on thorough market research, offer an easy-to-follow guide for timing your trades.

- Risk Management as a Safety Net

While signals suggest when to trade, risk management ensures you’re only taking risks that fit within your personal trading strategy and tolerance. Simple practices like setting stop-loss orders can effectively protect your investments from significant losses.

- Balancing Decisions with Strategy

Combining signals with risk management helps balance spontaneous decision-making with a structured strategy. This approach makes it easier to remain disciplined, even in fluctuating market conditions.

- Enhanced Confidence in Trading

The clarity provided by signals, coupled with the security of risk management, boosts confidence in your trading choices. This increased confidence can make the trading process feel less intimidating and more manageable.

- Flexible Adaptation to Market Changes

Free trading signals keep you updated with real-time market movements, allowing for quick adaptation. Risk management strategies ensure that these adaptations don’t stray from your overall trading goals.

- Simplified Analysis for Better Decisions

Trading signals simplify the analysis process, providing clear indicators that are easy to interpret. Risk management adds a layer of caution, ensuring that decisions based on these signals are made with a safety-first mindset.

By following these straightforward steps, traders can easily integrate risk management and free trading signals into their routines. This synergy not only simplifies the trading process but also enhances the potential for successful outcomes.

Making Informed Decisions

Incorporating both risk management and free trading signals into your trading approach can significantly enhance decision-making. It allows traders to make more informed choices about when to enter and exit trades, and how to manage their investment portfolios effectively.

Risk Management Tools and Techniques

Risk management in trading, while a crucial aspect of investing, doesn’t have to be complicated. Here are some straightforward yet effective tools and techniques that can be easily incorporated into your trading strategy:

- Setting Stop-Loss Orders

A stop-loss order is a simple tool that automatically sells a security when it reaches a certain price, effectively preventing substantial losses. This technique is especially useful in volatile markets, as it allows traders to set a predetermined level of risk and potentially minimize losses without needing to constantly monitor their positions.

- Diversification in Investment Portfolios

The old adage “don’t put all your eggs in one basket” holds true in trading. Diversification involves spreading your investments across various assets, sectors, or geographies. This strategy can reduce the impact of any single failing investment on your overall portfolio. For instance, if one stock declines, another in a different sector may rise or remain stable, balancing the overall portfolio performance.

- Risk-Reward Ratio Analysis

Before making any trade, consider the risk-reward ratio, which helps determine whether the potential return of an investment is worth the risk. A favorable risk-reward ratio, such as 1:3, indicates that the potential profit is three times the potential loss, making it a more appealing trade decision.

- Regular Portfolio Review and Adjustment

Regularly reviewing and adjusting your portfolio ensures that it aligns with your current risk tolerance and investment goals. This can be as simple as checking your investments periodically and making adjustments as needed based on performance and changing market conditions.

- Use of Risk Management Software

There are various risk management software tools available that can help in tracking and analyzing your investments. These tools often provide valuable insights into your portfolio’s performance and can suggest adjustments to align with your risk management strategy.

Incorporating these techniques into your trading routine can help in effectively managing risk, making the process more approachable and less daunting.

Evaluating and Selecting Trading Signals

Not all trading signals are created equal. Evaluating the reliability and relevance of signals is crucial. This can involve combining technical analysis with signals to assess their potential effectiveness in your trading strategy.

The Impact on Trading Strategies

Implementing a trading strategy that synergizes risk management and free trading signals can lead to more consistent and potentially profitable trading outcomes. It enables traders to capitalize on market opportunities while keeping risk at manageable levels.

Imbibe these Best Practices as an Investor

For investors, best practices include a thorough evaluation of free trading signal providers, understanding the methods used to generate these signals, and consistently applying risk management techniques in all trading activities. The integration of risk management and free trading signals is a formidable strategy in the arsenal of any investor. This combination not only enhances financial decision-making but also plays a pivotal role in the successful implementation of trading strategies.

Supercharge your investments with a powerful strategy! Explore the combination of risk management and free trading signals to optimize your financial decisions with https://sigzytradesignal.com/. Access reliable signals and implement smart risk management for successful trading today!