Why should you utilize forex algorithmic strategies in the UK?

It’s no secret that algorithmic trading is becoming increasingly popular in the forex world. But why is this? And why should you consider incorporating algorithmic strategies into your own trading routine? In this article, we’ll look closely at these questions and more. So, if you’re curious to learn more about the benefits of using algorithms in your forex trading, read on.

What are forex algorithmic strategies, and how do they work?

In simple terms, algorithmic forex strategies are sets of rules or conditions followed by a computer program to place a trade. These rules can be based on anything from technical indicators to price patterns. Once the rules have been set, the program will automatically place trades according to them.

There are many reasons why you might want to consider using algorithmic strategies in the UK forex market. First, the UK market is one of the most liquid and volatile in the world, and there are always plenty of trading opportunities available. And, as we’ll discuss below, algorithms can be particularly useful in volatile markets.

Another reason to use algorithmic strategies in the UK market is that fees and commissions are generally relatively low. It is especially true if you compare the cost of trading with a traditional broker to that of a commission-free online broker. When you factor in the lower costs, it’s easy to see how algorithmic trading could save you money in the long run.

What are the benefits of using algorithmic forex strategies?

Many benefits come with using algorithmic strategies in the UK forex market. First of all, as we mentioned above, algorithms can help you to take advantage of volatile markets, and this is because they allow you to enter and exit trades very quickly. And in a volatile market, this can be the difference between making a profit and making a loss.

Another benefit of using algorithmic strategies is that they can help you to diversify your portfolio. It is because you can use them for trading multiple currency pairs, and you’re not putting all your eggs in one basket, which can be riskier.

Finally, algorithms can take emotion out of the equation. It is because they don’t require you to decide when to enter or exit a trade. Instead, they follow the rules that you’ve set for them. It can be helpful if you’re prone to making impulsive trading decisions.

So, there are many reasons why you might want to consider using algorithmic strategies in your forex trading. However, it’s important to remember that they’re not suitable for everyone. If you’re new to forex trading or don’t feel comfortable letting a computer program make trades for you, then algorithmic trading might not be suitable for you.

How can you get started with algorithmic trading?

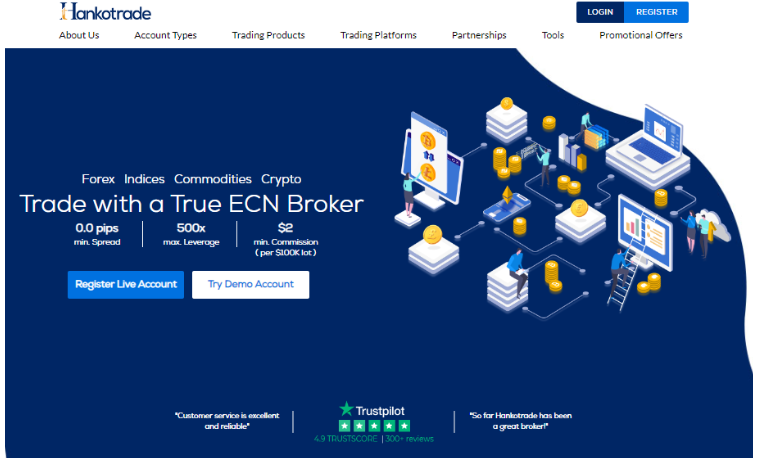

If you’re interested in trying out algorithmic trading, there are a few things that you need to know first. First, you’ll need to choose a broker that offers this type of trading, and not all brokers do, so it’s essential to check before you sign up.

Once you’ve found a suitable broker, you’ll need to choose the right software. There are many different options available, so it’s worth researching to find the one that best suits your needs.

Finally, you’ll need to set up your algorithms, which involves deciding what rules they should follow and how they should place trades. If you’re unsure where to start, plenty of resources available online can help you.

Are there any risks associated with using these strategies?

As with any trading, there are risks involved in using algorithmic strategies. First, if you don’t choose the right broker or software, you could lose money. It’s essential to research and ensure that you’re using a reputable platform before you start trading.

Another risk is that you could inadvertently create a “back door” for yourself. It is where your algorithm trades on information it shouldn’t have access to. For example, if you allow your algorithm to trade on insider information, this could be illegal. So, it’s essential to ensure that you understand the rules surrounding algorithmic trading before you start using these strategies.

Finally, there’s always the risk that your algorithm could make a mistake, possibly due to a programming error or because the market conditions have changed. So, it’s essential to monitor your algorithms closely and be prepared to intervene if they start making trades you’re uncomfortable with.