Best Investing Books for 2024

Whether you’re a seasoned trader or just getting started with your first investment, it’s always a good idea to know the rules and trends, and to stay on top of them as they change. Technique tips and insights from successful investors can also be extremely beneficial. Before you invest your next dollar, learn what others are doing and how and why they’ve been so successful.

The Intelligent Investor

Benjamin Graham, the author of “The Intelligent Investor,” was a renowned professor known as the “godfather of investing” before his death, and Jason Zweig, a Wall Street Journal columnist, adds some commentary to this revised edition.

This book takes a different approach to investing than other books, but it is not without encouragement. It won’t teach you how to make millions, but it will teach you how to keep your shirt on. From recommended strategies and how to analyse stocks to a comprehensive history lesson on the stock market, the authors impart must-read basics to get you started in investing and keep you going for a long time. The first edition of this book was published in 1949, and Warren Buffett has called it “the best book on investing ever written.”

The Little Book of Common sense Investing

John C. Bogle is credited with creating the first index fund, indicating that he was well-versed in the field of investing. He was also the founder of Vanguard Group, and he and Warren Buffett were rumoured to be best friends. Buffet even endorsed Bogle’s book, stating that “large and small investors” should read it.

The surprising approach taken by “The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns” is that the stock market is a lose-lose proposition for many investors. Bogle goes on to explain how he was able to change the odds in his favour. This isn’t his only book, but it’s the one in which he covers his own unique techniques and truths in a concise manner.

The Book on Rental Property Investing

If you’re interested in making money from rental properties, “The Book on Rental Property Investing: How to Create Wealth and Passive Income Through Smart Buy & Hold Real Estate Investing” is a great place to start. Brandon Turner breaks down the tips and tricks you’ll need to become a successful rental property investor in almost 400 pages. This investment book’s practical, “how-to” style has been praised by reviewers, making it suitable for both beginners and experts. You’ll discover the author’s four simple strategies, as well as how to find incredible deals, pay for your rentals, and why so many real estate investors fail. Turner is a real estate investor and co-host of The BiggerPockets Podcasts, one of the most popular business podcasts today, so you can trust his advice.

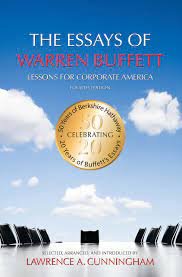

The Essays on Warren Buffett

“The Essays of Warren Buffett: Lessons for Corporate America,” now in its fourth edition, is a must-read for anyone interested in learning from the best. It’s difficult to think of a more successful investor than Warren Buffett, and he’s taken the time to share what he’s learned over the years.

The title refers to “corporate America,” but it can also refer to shareholders. The book provides a clear explanation of the relationship between corporations and their shareholders, making it ideal for beginners. Furthermore, this anthology of essays spans more than 50 years.

A Random walk Down Wall Street

Burton Malkiel understands that investing does not always imply spending hours managing a broad-based, extensive portfolio. To begin, you must learn to speak the language, or at the very least comprehend what is being said when someone else does. Malkiel’s book includes a glossary of investment terms, which he applies to a variety of investment strategies tailored to different stages of life. He focuses on long-term investments rather than get-rich-quick schemes, as well as price prediction and avoiding common pitfalls. This is a new edition of a book that has been around for quite some time. More than 1.5 million copies of “A Random Walk” have been sold.

Thinking, Fast and Slow

Daniel Kahneman is a psychology professor at Princeton University who also knows a thing or two about finances, having won the Nobel Prize in Economic Sciences in 2002.

“Thinking, Fast and Slow,” his New York Times bestseller, delves into how your thought processes can affect your investment success. Everyone has their own little biases, which they may or may not be aware of. Kahneman explains how to spot your own and lock them away so you can think clearly, rationally, and analytically when making investment decisions. It’s important to note that this book isn’t just about investing, though that is its primary focus. Kahneman also discusses how biases can influence our daily lives and financial decisions.

Rich Dad Poor Dad

Since its publication over 20 years ago, “Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!” has remained one of the most influential personal finance and investing books. In it, author Robert Kiyosaki tells how he grew up with “two dads”—his biological father and his best friend’s father, or his “rich dad,” and how both men influenced his investment views. This honest and inspiring book debunks the myth that you need a high income to be wealthy, explains the differences between working for money and making your money work for you, and offers advice on how to make your money work for you.

The Only investment guide you’ll ever need

For good reason, “The Only Investment Guide You’ll Ever Need” has been around for over 40 years. Don’t worry, it isn’t outdated advice from the 1970s. It was last updated in 2016 to reflect current economic conditions and trends.

Andrew Tobias isn’t only concerned with the wealthy investor. He gives advice to those with less money, and he does so in a straightforward, easy-to-understand, and often humorous manner. He dedicates the book to his broker, who, he says, “made me just that from time to time.” To date, this book has aided in the education of over one million readers.

One Up on Wall Street

Author Peter Lynch claims in his book “One Up On Wall Street: How to Use What You Already Know to Make Money in the Market” that newbie investors can not only do as well as—if not better than—the pros, but that they already have everything they need right at their fingertips.

Lynch believes that good investment opportunities can be found just about anywhere. They litter the ground beneath our feet, and all we have to do is slow down, take a breather from our daily routines, and bend down to inspect the mess in order to pick out the best options. We’ll be able to beat the pros to the punchline and get in on an investment opportunity before the rest of the world realises its value. Since its release in 2001, “One Up on Wall Street” has sold over one million copies.

Principles: Life and Work

One of Time magazine’s 100 most influential people in the world wrote this No. 1 New York Times bestseller. Ray Dalio, a typical middle-class kid from Long Island, started his investment firm in his New York apartment. Forty years later, Fortune ranked his firm, Bridgewater Associates, as one of the top five in the United States.

“Principles: Life and Work” is a book that is both autobiographical and educational. Dalio reveals his secrets and insights, as well as how businesses, individuals, and organizations can implement them, including a set of rules for applying them to investing, life, business, and personal finances in general.